30 Sept

GBP.USD

The pound has been cratering lately. The current account is terrible (?GBP 110 B, ~ 5% of GDP), the budget deficit is worse (14% of GDP). The UK is not the US: it’s currency is not a reserve currency, it doesn’t export any oil, or have significant reserves relative to its own consumption. It looks pretty weak. These things haven’t mattered for a while, but things can often be ignored by the markets until they aren’t.

The added complication is that both the Bank of England and the Treasury seem hell bent on making things worse. The Bank is reluctant to keep buying gilts, the Treasury is looking at tightening fiscal policy, because … “sound money”.

The economy has a terrible supply problem at the moment, which has caused inflation to spike, which has no doubt spurred the Bank into action, but it’s likely that the general hangover from post-pandemic spending, plus the Treasury cutting spending and increasing taxes (some already announced, like increased taxes on dividends and increases in National Insurance (a payroll tax by any other name) is going to tip the country over the edge, in my view.

There are lots of factors affecting exchange rates, and a monetary tightening might be expected to strengthen GBP, but only if it is greater than in the US (for the rates against USD). This doesn’t much matter in the short run, anyway. The main problem is that safe assets, for the whole planet, are denominated in USD, so demand for this currency will be strong, which will exacerbate the problem.

Having said all that, I acknowledge that forecasting currency movements is a mug’s game, you would probably best avoiding any kind of speculation on this currency pair; not that this should be taken as advice of any sort.

I took Brent Donnelly’s Spectra Market’s daily newsletter as a starting point for this rant.

IBM

Josh Young has written a piece on Seeking Alpha arguing that IBM will never be able to make the sorts of investments that might allow it to challenge the FAANG. The argument is that it’s commitment to dividends is depleting its free cash flow so much that it will eventually run out of money.

Read the full thesis here.

Let them heat their homes with carbon offsets

Kuppy tells it like it is. He is all in on fossil fuels. The thesis is strong, but the world’s massed central bankers may be stronger. It’s an interesting battle to watch. There will be collateral damage.

Ever since I can remember, billionaires have been taking private jets to conclaves where they strategized on how to reduce other people’s carbon emissions. At the time, I thought little of it—billionaires need hobbies and all. Besides, true billionaire credentials are gained when a squadron of luxury jets arrives to lecture some impoverished country on why they don’t deserve electricity. It is as cringeworthy as Marie Antoinette advising starving Parisians to eat cake since they couldn’t afford bread. Then again, part of being a billionaire is proving how tone-deaf you can be, while getting away with it. Boys will be boys…

“Tether goes full Ponzi”

This is a great read. It reminds us that Tether is a Ponzi, but, well, nobody wants to sell while they are making good money out of it.

The story of the original Ponzi is fascinating, and is summarized in the article.

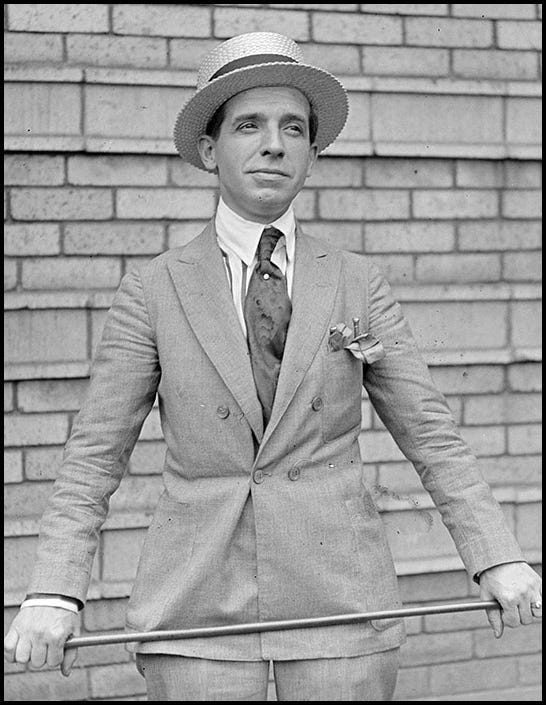

The guy just looked the part too:

Anyway, Doomberg is worth a follow, so enjoy!

Wrap

Today is the quarter-end. To add to the usual noise, there will be some realizing of profits and crystallizing of losses. The brinkmanship over the debt ceiling is going on: it seems inconceivable to me that it’s anything more than certain representatives holding out so they can sell their vote for the highest possible price. The US economy is not going to collapse because a bunch of politicians are playing hard to get, over a act of political theatre which is not even a feature of any other democracy. Supposedly, Congress will pass a bill to delay the day of reckoning until 3 Dec.

Commodities ground higher, in spite of the dollar remaining at elevated levels (DXY=94.2, down 13bp from yesterday though). Energy commodities of all stripes were up. Russian energy stocks, like $SNGS, $ROSN, $GAZP have had a stunning run. $LKOH was down 1%. If the dollar strengthens, emerging market oil stocks should have a double-strength tailwind, as long as they are bought on the local exchange. Not investment advice.

Emerging markets were under strain: USD.MXY was up 57bp. Bonds were down, but only 1.2bp on the 10Y yield.

NDX was up, 29bp, the other US indices down. No great vote of confidence from the bulls, but presumably the FAANG continue to be seen as safe haven stocks, in spite of valuation.

$APRN, Blue Apron bounced, up 15%, after being beaten down for a long time.

$THG:LSE is looking very, very sick. To me it looks like a pyramid scheme, but do your own research because I sure haven’t done mine.

Comments !