Crumbs

- Heard the one about the wooden car? Wooden body, wooden wheels, wooden engine, wooden go! Now we are going to have wooden satellites,

- Amazing pop in Gamestop ($GME): up over 1000% since April,

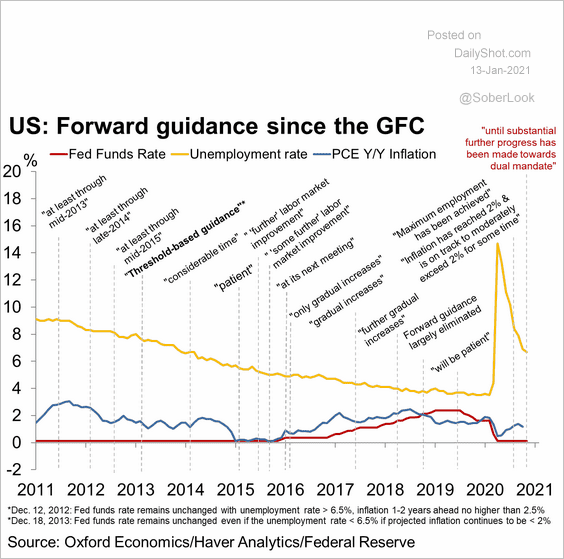

Interest rates look as though they are never going to get off the zero lower bound again.

Interest rates look as though they are never going to get off the zero lower bound again. - Biden appoints someone who isn’t an insider to the Senate Banking Committee. Biden has plenty of Wall St. insiders inside his administration, so whether or not this is consequential is moot,

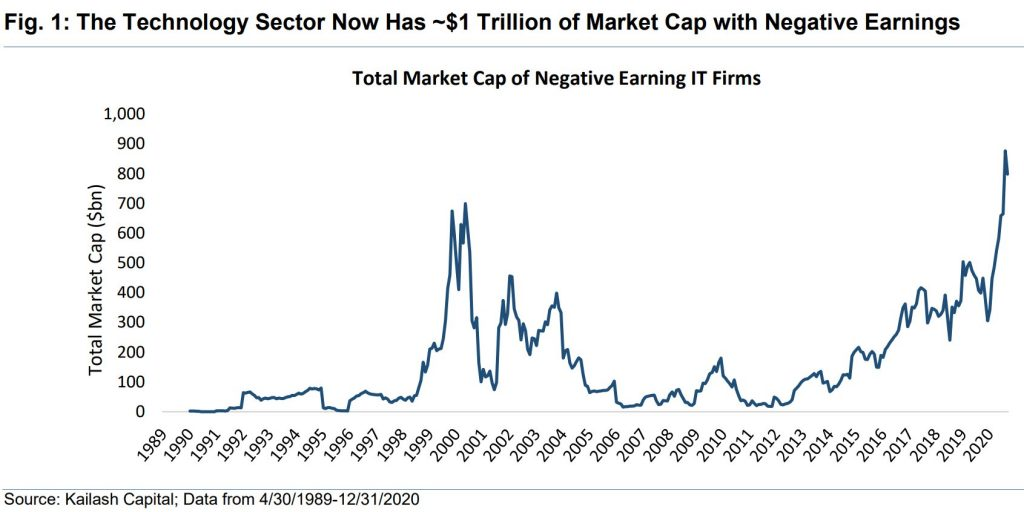

- We’re in a bubble, but you already knew that,

- Chinese debt issuers looking sick,

- US TY 10 year yields:

,

, - Dropbox is laying off staff. Who even uses it now?,

Wrap

The reflation trade is back on:

- crude (WTI) up 1.2%, to $53.6,

- 30 year Treasurys down 0.65% (futures),

- value sectors (energy, real estate, financials, industrials all up, between 3% and 0.3%),

- volatility (VIX) up to 23.45,

- some RobinHood favourites up insanely — $GME (Gamestop) has doubled,

- $BTC going crazy: $39.1K, up 8%,

- Curves steepening: 10s 2s up 72bp (on the week: Koyfin doesn’t show daily moves).

So, in summary, the rumours that the Fed was going to taper have been quashed. It’s a twitchy market though. My feeling is that the smart money is unloading onto the bagholders.

Comments !