Crumbs

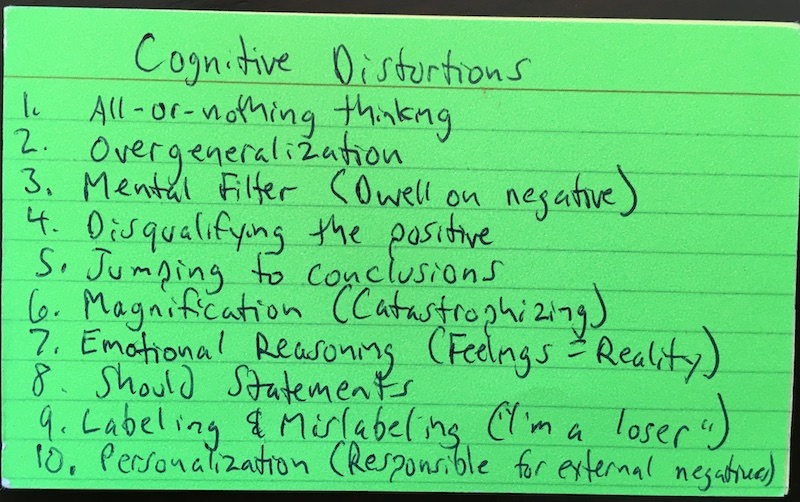

Mark E. Jeftovic has written a piece called Deconstructing “Wokethink” in which he tries to persuade us to guard against ten cognitive biases that lead us astray. He’s jotted them down on a handy card, but really you should read the whole article. He has targetted “wokethink,” but really these biases infect almost all forms of political discourse. We tend to focus more on negative things, for obvious reasons (things that are going well don’t need our attention). All the information we receive is filtered through our existing knowledge, with each sentence examined for consistency with our existing outlook. It’s immensely difficult to really embrace ideas that conflict with our beliefs, which is why it takes so long to move the famous Overton Window.

Weaker credit spread collapsing

This shows that weaker credits are paying less for their debt than previously (relative to their high score competitors). The conclusion of this is that inflation is going to take off, which, in moderation will result in improving margins. I don’t know what the typical Baa borrower is: a pretty strong company, I’d guess. The breakeven inflation rate (derived from TIPS prices)is showing a sustained rise.

I picked up this stuff from today’s Daily Shot,

Cables for capital appreciation

This article in the FT today is about Prysmian, Nexans and NKT. All firms involved in laying underseas power cables, which will increasingly be needed if offshore wind is going to have a meaningful impact on supplying global electricity demand.

Wrap

Pretty risk off today. The frothier shares falling quite sharply:

- $MSTR (MicroStrategy) down 20%. As volatile as a crypto currency!

- $REAL (the RealReal) down 14%,

- $TRCH (Torchlight Energy) down 17%,

- $CELH (Celsius Holdings) down 10.3%,

- $TSLA (Tesla) down 6.2%.

It’s been a while since anything ever declined in price. These stocks might bounce, but it’s less and less likely, I think. The wider market (at 5:50pm GMT) was down modestly: SPX 1%, NDX 2.3%, Russell 2000 2.4%. The market has rise so high, it had to give back some eventually. The Treasury has started spending the cash from the Treasury General Account. This is in some sense draining liquidity from the system.

Update: close of business, NY

A last minute ramp from Jay Powell in his semi-annual monetary policy report to Congress reversed the losses so that SPX ended up 0.1%. Bonds close to flat. DXY up 0.13%.

Commodities continued their upward march, with crude up to $61.86.

Overvalued stocks

| Ticker |

|---|

| FCEL |

| XES |

| PSCE |

| UAA |

| MITT |

| PDCE |

| YELL |

| FRAK |

| KODK |

| FLY |

| AIRYY |

| EMB |

| KRC |

| MLCO |

| IRM |

| LVS |

| CM |

| BNS |

| WYNN |

| BKNG |

| FXI |

| HLF |

| AGO |

| BA |

| TD |

| PAYX |

| SEAS |

| DIS |

| ITW |

| FB |

| EQIX |

| MCHI |

| CTXS |

| ALLY |

| CMG |

| GOOGL |

| SC |

| GRUB |

| XBI |

| FDN |

| JD |

| AVGO |

| EGRNY |

| MSTR |

| TRCH |

| SAM |

| AAPL |

| AMZN |

| NFLX |

| FTNT |

| W |

| MU |

| Z |

| MRTX |

| ALGN |

| NVDA |

| TSLA |

| ETSY |

| CELH |

| SHOP |

| BYND |

| LYFT |

| GDS |

| PTON |

| ROKU |

| SDC |

| SPCE |

| WORK |

| ZM |

| CHWY |

| NIO |

| UBER |

| OKTA |

| DOCU |

| DDOG |

| TTD |

| SNAP |

| CVNA |

| TWLO |

| CSPR |

| REAL |

| FVRR |

| FTCH |

| QRTEA |

| DKNG |

| MRNA |

| LMND |

| ROOT |

| EH |

| UAVS |

| BIN |

Not investment advice, but I’d be careful before going long these stocks.

Comments !