Crumbs

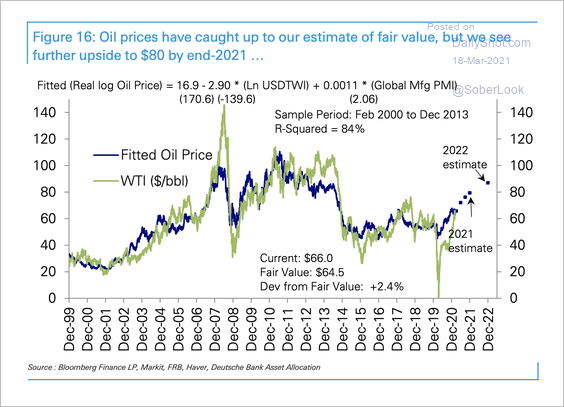

Oil forecast

Currently, oil is trending down.

Commodities fading

Strong move down in commodities. Is this the consensus trade fading?

Crazy Cathie lives up to her name

Just listen to her, if you can bear to. Pick up the remarks at around 11m30s. Insane: she breezily dismisses the risk …

read moreThere are comments.