Crumbs

- another bullish note on natural gas

- China equities look over bought. The market is heavily manipulated, and it’s not easy to short, but maybe it’s run out of steam for a bit,

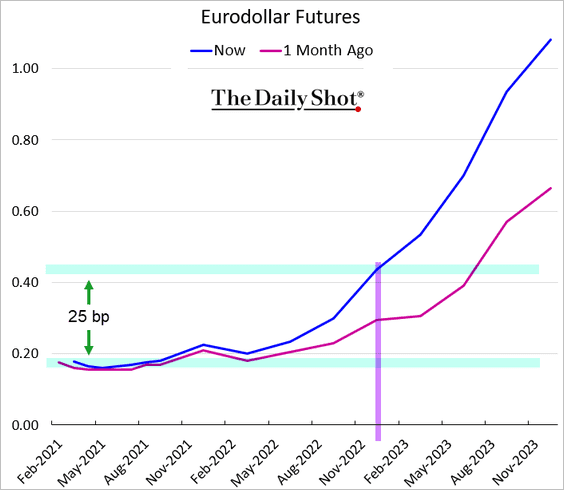

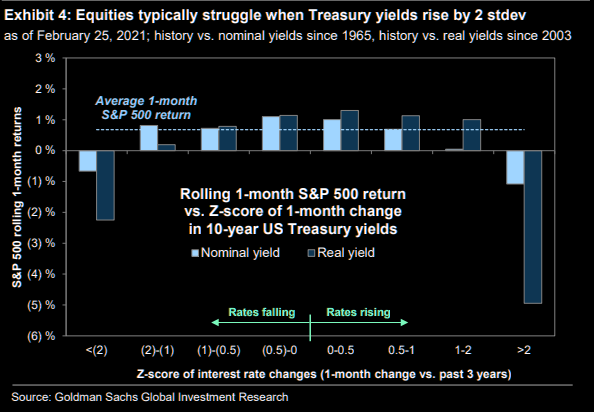

- Yield Curve Control is coming. But the Fed will not tell you it’s arrived …

There are comments.