2022-12-06

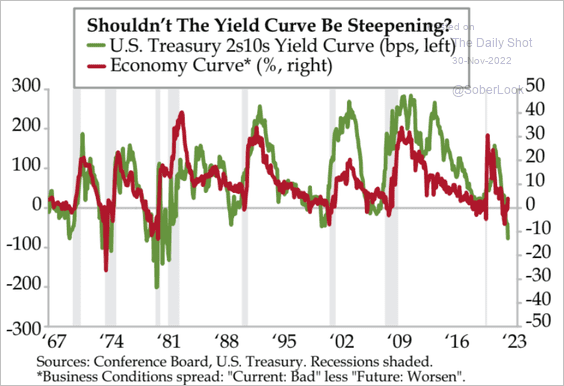

This article argues that the Fed is going to have to cut, and cut a lot, creating a huge steepening. Maybe the crash in oil prices (and the downturn in stocks, which amounts to a tightening) will be the nail in the coffin of further above-expectation rate hikes.

Wrap …

read moreThere are comments.