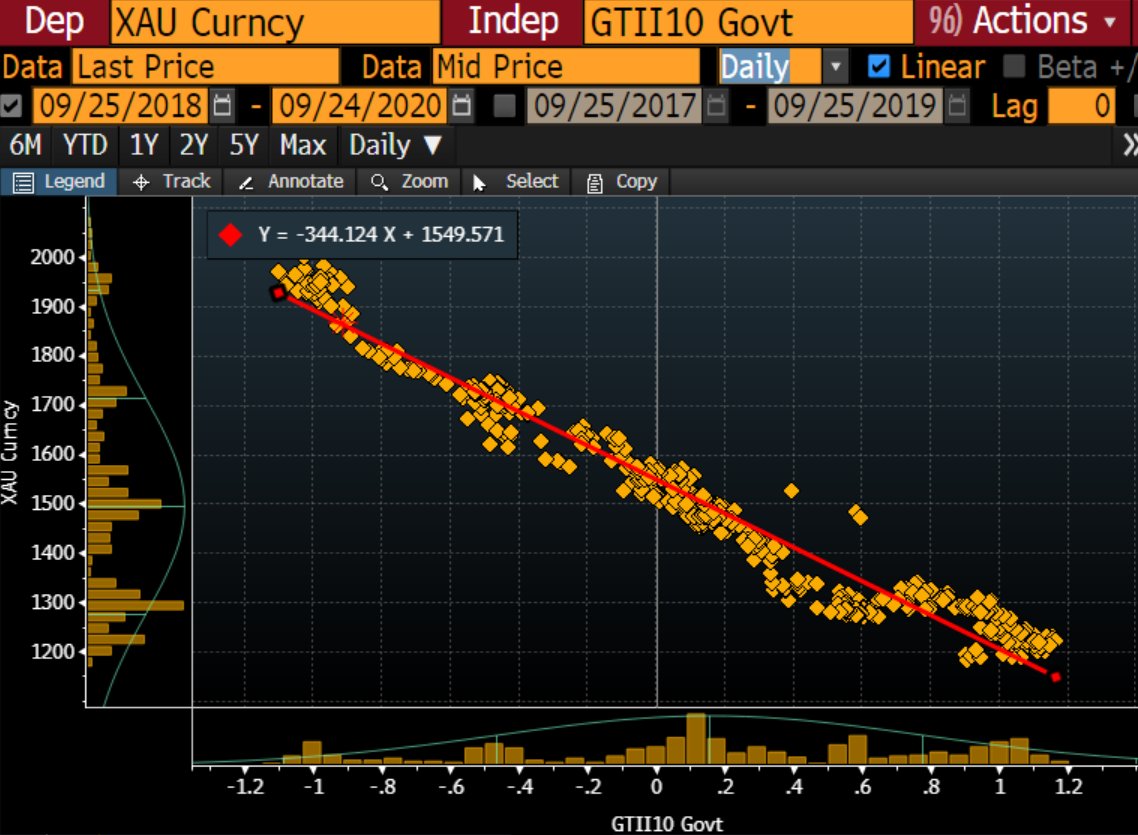

Gold and real rates

I just saw this plot posted by David Finch. It’s very clear cut.

Energy

I just feel that Covid has not changed the world so much that it no longer needs energy. I recognize that more electricity generation is going to come from wind and solar, and maybe nuclear. But a lot of transport and other uses (not least fixing of nitrogen) is going to continue to use lots and lots of oil. Suncor and Enbridge are two beaten down Canadian plays (one refining, one transport) that seem to offer value right now.

Crumbs

Socgen is in a mess as its equity derivatives business is no longer bringing in the dosh (FT, no link). Tik Tok row grinds on. Central banks still buying assets at a rate of $1.5bln per hour. ECB to let inflation run hot. This provokes some understandable skepticism.

Macro surprises in Europe are negative. This is not good for equities, historically.

Deaths from Covid are more than are reported. There is a lot of other data in this article from the Economist. Yes, I too felt that I’d already reached my lifetime budget of exposure to articles about Covid, but this one might justify going an extra few pages.

Californian chaos in processing unemployed claimants. Wolf Street is not an unbiased source, but tries to look a bit more deeply into specific areas than most news outlets. Unemployment is clearly going to be huge, after the stimulus programmes run out. It’s a pity that measuring it is so difficult. It’s an elusive number, because it’s definition requires people to be willing and able to work. How do you actually measure someone’s willingness to work?

India

Narenda Modi seems to be turning into a sub-continental Trump. This can’t be good for the Indian economy, or stock market. It’s not a big market, but I feel bearish about it. No charts or hard data, just a few crumbs of sentiment I’ve picked up.

Wrap

Equities finished the weak on an upbeat note, although only NDX was ahead of where it started. All sectors were up, except energy, tech being strongest, consumer staples weakest (apart from energy). Bonds were basically flat, apart from converts, which are really equity. Currencies flat (bitcoin up 1% vs USD). Emerging markets mixed, India up 2.1%, China down 1%. Evergrande looking hammered, after bonds stopped trading. It’s expected that the PBoC will bail them out, or the government. A developer that big has to be run by CCP cadres. Evergrande may not be a household name here, but it is the world’s biggest real estate company! China has been incredibly strong, supposedly because it got to grips with Covid well, all it’s numerous demographic and governance troubles conveniently ignored.

Comments !