Wrap

Equities, yields, commodities, dollar (vs Euro) up. Precious metals down. NDX flat, $INTC down.

News

US election, stimulus measures (UK & US), Covid, regional lockdowns, Brexit. The usual suspects. No real resolution.

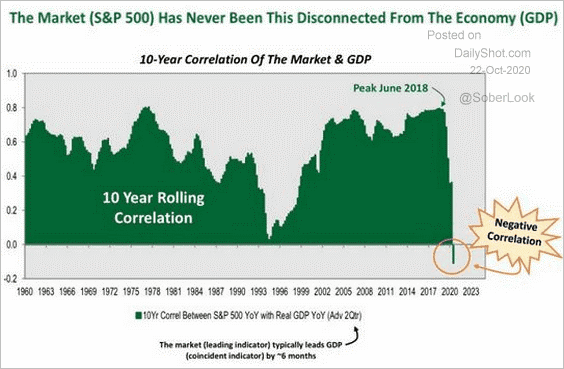

I was busy with personal stuff today. Normal service to be resumed tomorrow, hopefully. Something to ponder:

There are comments.