19 May 2021

Markets

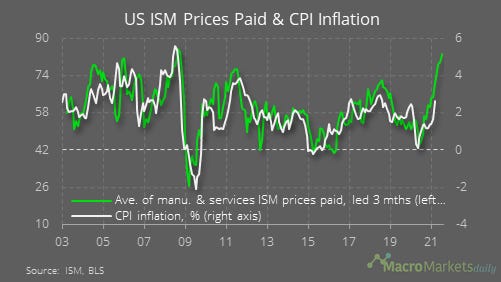

The Fed finally moved. Some committee members whispered the possibility of reducing QE, or “tapering” in the jargon. This knocked 3.2% off the price of oil (but see the item about the China credit impulse below). The markets are fixated by the Fed, because it …

read moreThere are comments.