Stock of the day

$TRUP:NMQ. Medical insurance for pets. I think it’s mad, but it may be lucrative. Do your own research, but its cashflow turned very positive last year, admittedly mainly through financing.

Wrap

Markets just haven’t had any clear direction recently. Equities, which have been …

read moreThere are comments.

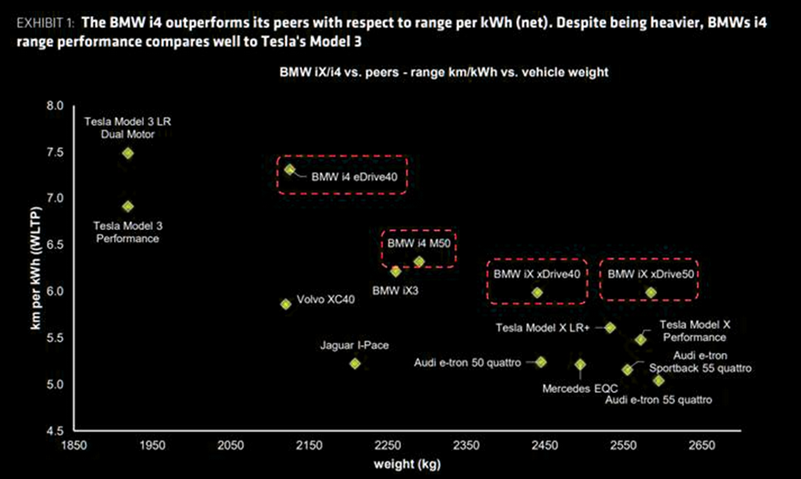

Most EVs weigh in excess of two tonnes.

In comparison, the kerb weight of the old Renault 4 (admittedly, a flimsy car) could be as low at 600kg, 30% of the

Most EVs weigh in excess of two tonnes.

In comparison, the kerb weight of the old Renault 4 (admittedly, a flimsy car) could be as low at 600kg, 30% of the