Crumbs

Wrap

- Gold and silver hammered. Rotation into bitcoin?

- momentum up, value down,

- All yields up except core Eurozone, and then only DE up for 30 year maturity,

- Euro weak against everything: stampede into US assets?

- All …

There are comments.

There are comments.

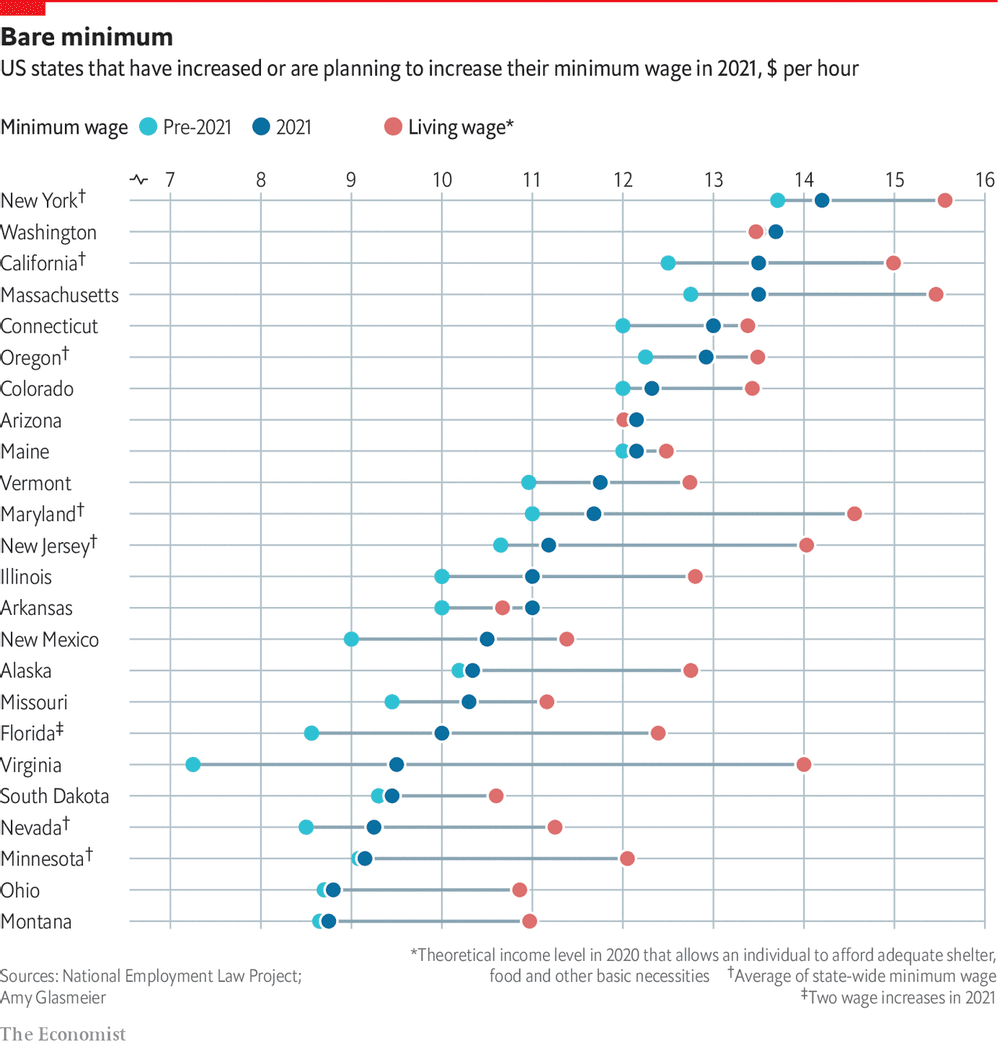

The US is getting much more comfortable about interfering the the labour market — The Economist.

The US is getting much more comfortable about interfering the the labour market — The Economist.There are comments.

‘Lockdown hasn’t been all bad — it’s made me focus on what I really want out of life.’

‘Lockdown hasn’t been all bad — it’s made me focus on what I really want out of life.’

The Daily Shot today has some lovely charts.

- TIPS investors see inflation coming …

- TIPS investors see inflation coming …

There are comments.

This article by By Neil Irwin and Weiyi Cai explains how it can be that shutting down so much of the US economy can result in US consumers having an extra $1Trn to spend or save. Basically, there was a lot of govt. support, and a relatively small number …

read moreThere are comments.

There are comments.

The WSJ says that Quantumscape, which is developing solid state batteries that are superior to the liquid electrolyte ones already in use will disadvantage $TSLA because it uses rolled cylinder batteries, whereas its competitors all use prismatic ones. Solid state batteries cannot be rolled …

read moreThere are comments.

I’m old enough to remember when the money supply mattered, and was the determinant of inflation, albeit with ‘long and variable lags’. Now, nobody (except Taps Coogan) cares. But all things, including economic theories, move into and out of fashion, so maybe the time has come.

There are comments.

There are comments.

Tobin’s Q is the market cap (of the SPX) as a multiple of the replacement cost of the assets. When a lot of assets are software and market dominance, this is hard to measure. Either the market is massively overvalued or the metric is no longer meaningful. Suggested …

Tobin’s Q is the market cap (of the SPX) as a multiple of the replacement cost of the assets. When a lot of assets are software and market dominance, this is hard to measure. Either the market is massively overvalued or the metric is no longer meaningful. Suggested …

There are comments.