Crumbs

- Shipping predicted to shape up. Again.

- trade is picking up again nicely, thanks:

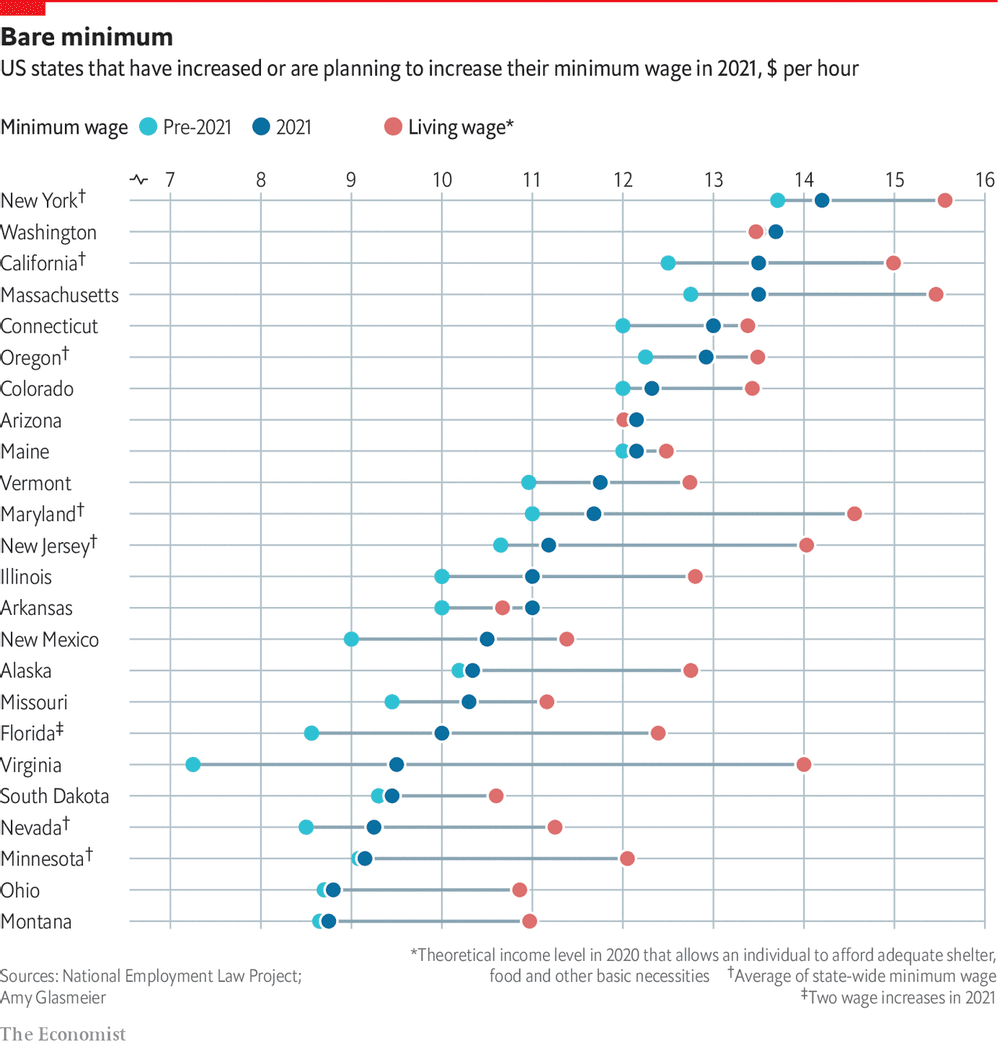

- it’s a better time to be a low-paid worker in many US states:

The US is getting much more comfortable about interfering the the labour market — The Economist.

The US is getting much more comfortable about interfering the the labour market — The Economist.

There are comments.

‘Lockdown hasn’t been all bad — it’s made me focus on what I really want out of life.’

‘Lockdown hasn’t been all bad — it’s made me focus on what I really want out of life.’

-

-